We may not have the course you’re looking for. If you enquire or give us a call on +1 7204454674 and speak to our training experts, we may still be able to help with your training requirements.

Training Outcomes Within Your Budget!

We ensure quality, budget-alignment, and timely delivery by our expert instructors.

.png)

Companies use the Salary Slip Format to maintain a record of the monthly payroll of the employees. Microsoft Excel is one of the widely used tools for creating Salary Slip Formats because it allows you to create own formats and use them forever. Moreover, you can also download from variety of Salary Slip Formats from the internet and use them in Excel. According to research conducted by Statista, 86% of US companies use Microsoft Excel for various tasks. .

Read this blog to create a Salary Slip Format in Excel with the right formula and components of salary slips to make functional payslips/monthly salary slips for the company. So, let's discuss all the topics related to the professional salary slip format in this blog.

Table of Contents

1) What does a Salary Slip mean?

2) How do you make a Salary Slip format in Excel?

3) Examples of simple Salary Slip format in Excel

4) Why and where is a Salary Slip Needed?

5) What are the components of a Salary Slip

6) A few basic Salary Slip Formulas

7) Advantages of Excel Spreadsheets to format Salary Slip

8) Conclusion

What does a Salary Slip mean?

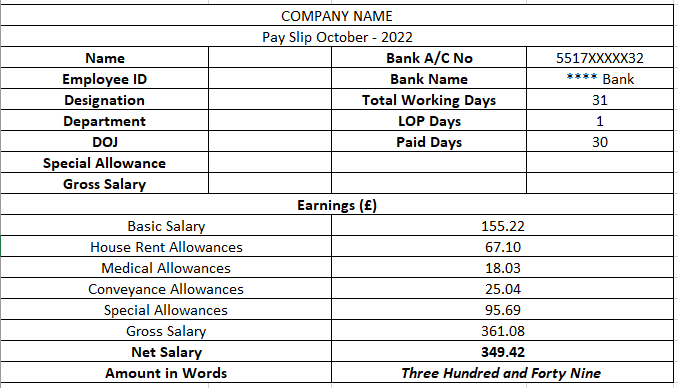

A Salary Slip is a report generated by an organisation to keep employees' payroll, attendance, and other job-related information on record. Usually, a Salary Slip contains the Name of the Organisation, Employee Name, Employee ID, Date/Month, Attendance for that month, Employee Bank A/C details, Gross Salary, Provident Fund, Home Rent Allowance, Deductions, Bonus, and more.

Salary Slip is also referred to as Payslip, as it contains payroll details of the employees.

Each organisation has its Salary Slip Format designed mainly by an HR or an Accountant to keep track of employees' salary details.

How do you make a Salary Slip Format in Excel?

Here are the steps you need to follow to create a salary slip format in Excel.

First, make sure you have MS Excel working on your computer system. If not, download one from the Website. You can also find many free versions available on the internet.

1) Once you open MS Excel, create a file name and save it in a location from where you can access it easily.

2) Open a new Excel Sheet and write your company name, company address, month & year of the salary slip within the first three rows.

3) Make two columns and enter the general details of the employee like Name, designation, ID, Department, Date of Joining (DOJ), Bank details, Attendance details, and any other information you feel is required.

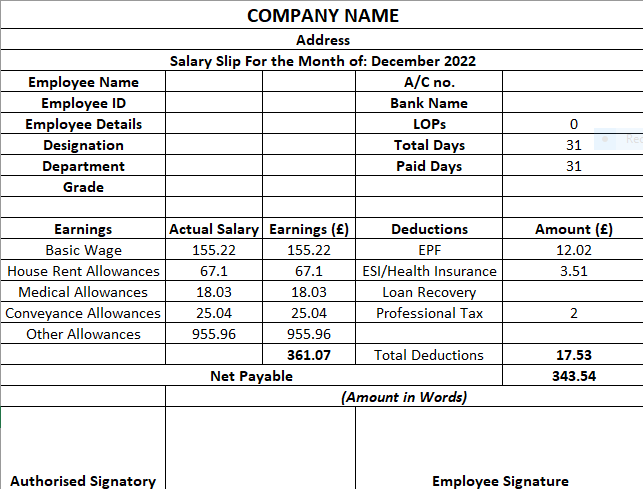

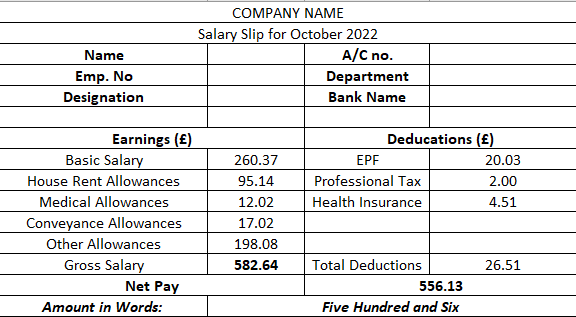

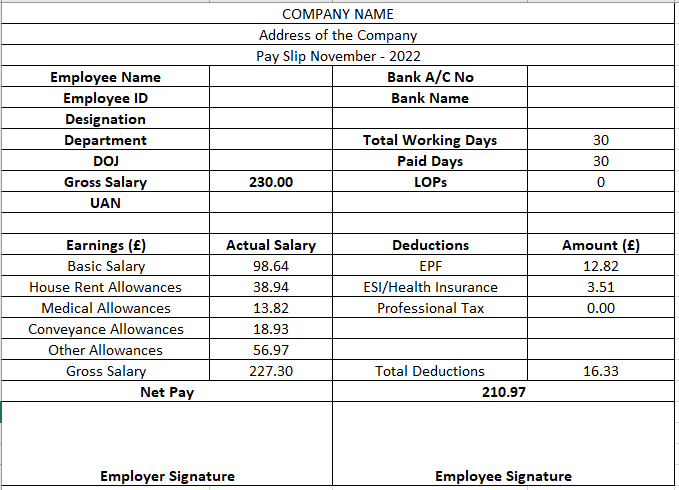

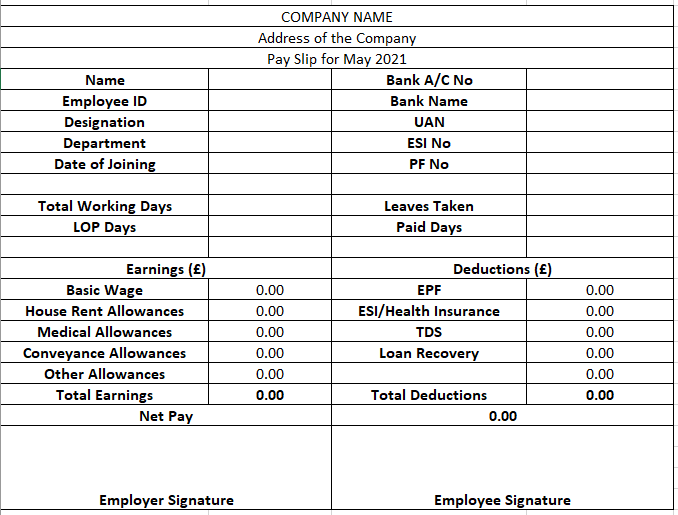

4) Leave a row and start by entering the employee's salary structure in the columns as shown in the image. In one column, you can add the earning details such as Basic wage, HRA, Medical allowances, Conveyance, and other special allowances. Make two columns next to it and add the Actual salary of the employee and Earnings in another column. The total earnings will be calculated based on the number of days the employee has worked.

5) You can specify the deductions in another two columns and add the deduction amount in the specified row. The deduction column includes PF, ESI, Professional Tax, and TDS.

6) And finally, add the Net payable amount in words. Add signature column for the company and employee.

You can fill in all the relevant details of the employees in particular cells once the Salary slip format is completed.

Examples of simple Salary Slip Format in Excel

Following are some simple Salary Slip Formats given for your referral.

Following is a Salary slip format without PF and ESI

Why and Where is a Salary Slip Needed?

The Salary slip is crucial to both the Employees and the employer of the company. It is mostly sent to employee’s mail IDs every month. Following points describe the importance of Salary Slip for employers and employees.

For the Employer

The employer needs to keep track of the wages given and data about its employees. Additionally, the accountant needs an accurate Salary Slip to process or transfer the precise salaries to its employees.

For the Employee

It helps the employee to make a cross-verification on the salary received each month.

You must check if the number of working days, leaves, and deductions are calculated right. If not, the issue can be escalated to HR to address the problem you have noticed in your Payslip.

And if you plan to switch a company, the Salary slip for the last three months would be required to decide and confirm your newly offered salary.

Become a skilled Microsoft Excel professional with Microsoft Excel Course. Enquire now!

What are the components of a Salary Slip?

It is important for both the employee and employer to know about the components or terms used in the Salary Slip.

The list of components is mentioned below:

Earning

Basic Salary

The Basic Salary is the fixed amount paid to an employee at the end of each month. It comes close to 40 – 50% of your Cost to Company (CTC). The Basic Salary is taxable in case it exceeds the limit of the Income Tax slab drawn by the government.

House Rent Allowance (HRA)

The Home Rent Allowance (HRA) is an amount paid to the employees by their employer according to the regions they live in and the amount of the salary drawn. The HRA amount will vary based on your salary grade and the city you are residing in.

Conveyance Allowance

Conveyance Allowance is the amount provided to the employees for their expenses on travel from the place of residence to the office (work) location and vice versa. It is calculated monthly based on the employee's working days (present as per attendance).

Medical Allowance

The organisation decides on the amount of Medical Allowance permitted to its employees. The organisation fixes the Medical Allowance amount. It is included in the salary and transferred to the employee every month.

Travel Allowance

The Travel Allowance is the amount paid to the employees in case of travelling for business purposes.

Special Allowance

Special Allowance can be granted as a performance based-pay or a fixed pay over the Basic Salary if the employee meets certain requirements.

Dearness Allowance (DA)

Dearness Allowance is paid between 4 – 10% of the Basic Salary, depending on the contract signed during onboarding. It is an amount paid as a living cost adjustment allowance.

Bonus

Bonus Pay is paid to the employees annually as a reward based on the company's and the employees' overall financial performance which is closely monitored through effective Financial Performance Management practices.

Deductions

Provident Fund (PF)

Provident Fund, commonly known as PF, is a retirement benefit deducted from the employee's gross salary. Mostly, every organisation has made PF a mandatory deduction for its employees.

The government decides the Provident Fund per cent rate. Your PF amount will be returned to you at retirement or when making a claim.

Professional Tax

The Professional Tax is deducted from your monthly salary income. This deduction amount goes to the respective government of the state.

TDS

TDS stands for Tax Deducted from the Source. The TDS is an Income Tax that applies to the employees’ salary. Some companies deduct it from the employees’ salaries and pay it collectively to the department. If not, you must pay the tax yourself if it applies to you.

Salary Advance

Salary Advance is permissible in only a few companies that are ready to pay the entire or some salary in advance. If your plea gets approved, the sanctioned Advance Salary amount will be deducted from your gross salary in the coming months.

Upgrade your career and become a professional Microsoft Excel Expert with Microsoft Excel VBA and Macro Training. Join now!

A few basic Salary Slip Formulas

Following are a few basic Salary Slip Formulas which can be useful when making a Salary Slip Format.

|

1 |

Net Salary |

Total Earnings – Total Deductions |

|

2 |

Gross Wage |

Basic wage + HRA + Conveyance + Medical + Special Allowances |

|

3 |

CTC |

Gross wage + Employer PF Contributions + Other Benefits given by employer |

Advantages of Excel spreadsheets to format Salary Slip

Along with being free to use and customisable, there are several other advantages of using Excel spreadsheets to format salary slips. Let's look in detail at these advantages:

1) Easy to alter and analyse data:

While creating Salary Slips many a times users might want to change data entries in a range of cells. Using Excel makes it easy to add, subtract, divide and multiply these data sets. Users can also remove duplicate data, retrieve data from other tabs, and search all rows and columns for a particular range.

2) Incorporate spreadsheets with certain tools:

It is advantageous to use tools outside of Microsoft domain such as Google Sheets. In-built Excel tools such as Zapier and Integromat can automatically upload spreadsheet data into management software.

3) It is quick and easy to add into a workflow:

Users can create a spreadsheet and share it among all team members. This is an easy way to integrate into the team’s workflow regardless of your team’s size. Thus, it can provide you with multiple layers of data all at once.

4) Spreadsheets tools ease documenting finances:

If you want to create balance sheet, business budgets and even cashflow statements, then Excel spreadsheets are for you. It is easy to maintain Salary Slips using Excel as it provides an easy access to operate the numbers and generating a new spreadsheet statement every quarter.

5) Access countless spreadsheet templates:

Excel provides countless number of templates to store data according to user’s convenience. Even to account data in numbers. It has a business template to particularly handle financial datasets.

6) Users can visualise data:

Data visualisation tools such as pivot tables, pie charts, graphs make it easy to understand trends and track yearly, monthly, quarterly and even weekly changes in the data. While salaries may differ at different points of time, users can easily present these changes in one go using other Basic Excel Functions such as NOW (to know the current salary data).

Conclusion

This blog consists of various details about the Salary Slip Format in Excel. After reading this blog you would've understood the different components used in a Salary Slip, its benefits to employees and employers, and the diverse Formats that can be used to design a Salary Slip Format in Excel.

Become an Excel Expert by learning how to create advanced Excel formulas, macros and much more in our MS Excel training. Sign up for Microsoft Excel Course Now!

Frequently Asked Questions

Upcoming Office Applications Resources Batches & Dates

Date

Microsoft Excel Course

Microsoft Excel Course

Fri 20th Sep 2024

Fri 15th Nov 2024

Fri 20th Dec 2024

Fri 10th Jan 2025

Fri 14th Feb 2025

Fri 11th Apr 2025

Fri 23rd May 2025

Fri 8th Aug 2025

Fri 26th Sep 2025

Fri 21st Nov 2025

Top Rated Course

Top Rated Course.png)

If you wish to make any changes to your course, please

If you wish to make any changes to your course, please